Alternative Investments For Finance Professionals

If you have high-net-worth clients seeking alternative investment options, we’ll source opportunities for secured, fixed-yield returns which are asset-backed or insured.

What we offer

We only present thoroughly evaluated opportunities that pass our highly rigorous compliance and due diligence checks.

We provide all the back-of-office support and sales assets you need to share with your clients, making doing business with us easy.

We are fully transparent in how we operate, giving you full visibility on all compliance and due diligence checks we carry out on the companies we work with.

What we do

Simple, Secured Investment Opportunities

We provide simple, secured investment opportunities with easy recourse via security trustees and insurance.

Provide General Investment Information

We offer educational sessions on investment strategies and market trends.

Due Diligence and Compliance Processes

We thoroughly evaluate potential investments to ensure quality and compliance.

Transparent Communication

& Reporting

We provide regular updates on investment performance and market conditions.

High-Quality Investment Options

We focus on secure, reliable investments such as loan notes and bonds (fixed income).

How we support finance professionals

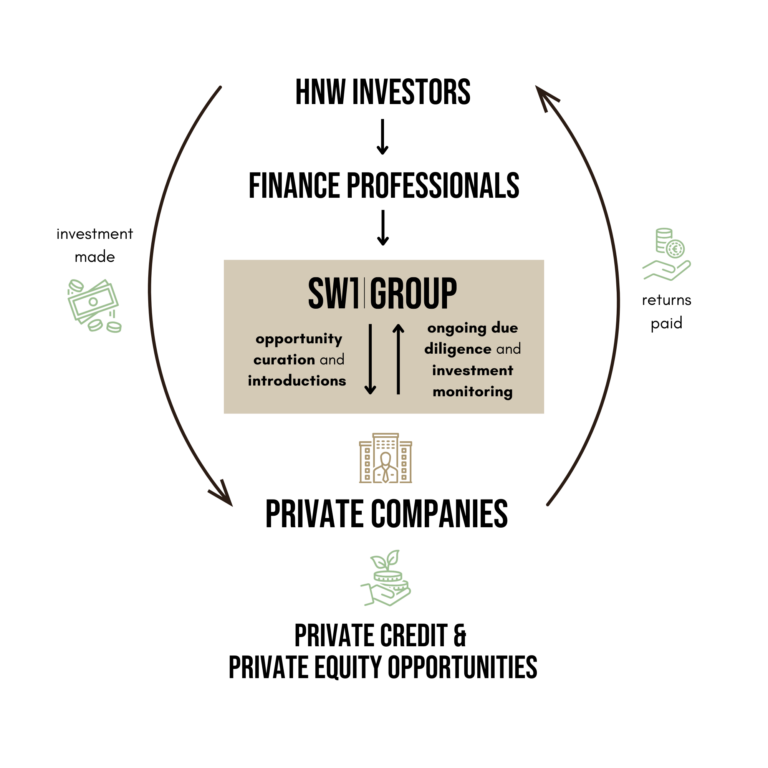

SW1 Group offer a carefully curated suite of private equity and private credit opportunities, specifically designed for financial professionals to recommend to their clients.

All investments are made directly from the investors to the companies we work with, ensuring that SW1 does not manage or hold client funds.

This structure enables us to remain independent and focused on sourcing quality opportunities for finance professionals.

Opportunity Curation

We select growth-oriented private companies seeking expansion capital, ensuring alignment with investor interests.

Introductions

We connect finance professionals with targeted alternative investment opportunities in private credit and equity, catering to high-net-worth and professional investors.

Ongoing Due Diligence

Our thorough evaluation process rigorously assesses risk and potential returns, maintaining strict standards.

Investment Monitoring

We provide continuous oversight and updates, ensuring transparency and informed decision-making.

Returns Paid

Our strategy is designed to identify opportunities that deliver favorable returns, fulfilling the investment goals of your clients.

Contact us to find out how we support finance professionals

Private Credit / Fixed Income

Many sophisticated investors around the world have been impacted by market instability. As a result, they’re looking for short-term, fixed income opportunities with the potential for higher returns. While there is still a place for traditional investments such as mutual funds and bonds, investors are looking for more.

If your high-net-worth clients are seeking to diversify their portfolio with alternative opportunities to secure their financial future such as private credit, we specialise in identifying short-term, high yield, secured investment opportunities with private companies and asset-based lenders.

The diverse range of opportunities you’ll find within our portal are exclusive to SW1 Group, and are available in multiple currencies.

Our private credit opportunities

We work with companies that operating in stable industry sectors with growth potential to package exclusive private credit opportunities.

These private loans are used, under strict mandates, for purposes such as buying assets or making asset-backed loans and the companies return the loans with interest.

Benefits of private credit

Fixed return

Interest payments are designed to offer a consistent income, though outcomes depend on the specific terms of the investment.

Non-correlated

Investment performance is not linked to the markets, therefore won’t be affected by market volatility.

Portfolio diversification

Adding non-correlated investments across a diversified range of products and companies can reduce overall risk.

Potential for strong ROI

Private credit investments may often yield higher returns compared to traditional investments, though they also carry additional risks that should be carefully considered.

Flexibility

Private credit opportunities can be tailored to meet the specific needs of both investors and borrowers, with terms that may vary in duration depending on the arrangement.

Thorough due diligence process

We hand-pick and carry out rigorous compliance checks on all opportunities.

Security

We prioritise investor security by ensuring that the products we facilitate offer protections such as debentures, first charges on assets, or comprehensive insurance coverage.

Book a call to explore our private credit opportunities

Private Equity

If your clients are seeking longer-term growth, we also work with growing companies to source exclusive private equity opportunities across a range of established industries.

Our private equity opportunities

If your clients are seeking longer-term growth, we also work with growing companies to source exclusive private equity opportunities across a range of established industries.

Benefits of private equity

While higher risk, private equity investments can deliver the following benefits:

High potential returns

When compared to more traditional investments such as mutual funds and bonds.

Access to exclusive opportunities

Carefully sourced by our team and typically not available through public markets.

Diversification

Helps your high-net-worth clients diversify investment portfolios.

Low-correlation

Low correlation with financial markets, therefore less likely to be affected by market volatility.

Oversight

We ensure oversight on the companies activities so a level of control is maintained.

Thorough due diligence

We carry out rigorous compliance checks on all opportunities we represent..

Book a call to explore our private credit opportunities

Due diligence and compliance checks

Every organisation we work with undergoes our rigorous due diligence and compliance checks to assess their credibility and creditworthiness – not just initially, but through the entire term of your client’s investment.

Exclusive Secure Portal

As a financial professional, you’ll get immediate access to our secure portal which outlines all our exclusive, rigorously checked private credit and private equity opportunities and provides all the information and sales assets you need to share with your clients.

Within the portal, you will find:

- Sales Aids

- Company Profiles

- Due Diligence

- Company Updates

- Market Updates

You will also be assigned a dedicated SW1 Group representative to answer any questions or provide further information as needed.